The subscription model has altered the way businesses develop and maintain consumers in the long run. The recurring revenue in the modern world is associated with the maintenance of various pricing models.

According to a study conducted by Juniper, it is estimated that the subscription economy will increase by 68 percent between 2025 and 2030.

This blog explores the best alternatives to Recurly for businesses managing subscription billing and recurring revenue. It compares leading billing platforms’ usage-based billing support, integrations, reporting, and scalability. we’ve finalized the 8 best Recurly alternatives that truly meet diverse business needs and evolving subscription models.

This sharp increase demonstrates why companies require billing software capable of supporting usage-based pricing, handling recurring charges and keeping pace with the changing business requirements as they occur.

Why Businesses Need a Recurly Alternative

Recurly has long been known as a reliable platform for subscription billing and is used by many brands around the world. It supports businesses in handling recurring payments and managing billing tasks. Many start looking for tools that go beyond basic invoicing and can support custom workflows and changing business plans.

8 Top Recurly Alternatives

We have compiled a list of the 8 most popular Recurly alternatives that can be used by businesses to select the appropriate option that enables flexible pricing model, business expansion, and reliable subscription billing.

Product | Integrations | Trial Period |

Revenue 365 | SharePoint, MS Teams, Outlook and Power BI | 14 days |

Zuora | NetSuite, HubSpot, SAP and Workday | 30 days |

Chargebee | Quickbooks, Hubspot, Google Analytics and Slack | 14 days |

Paddle | Hubspot, Intercom and Databox | 30 days |

Maxio | Pipedrive, Salesforce, AWS | 30 days |

Zoho Subscription | Zapier, Zendesk and with Zoho Suites | 14 days |

Dealhub.io | Salesforce, Xero, and Avalar | Connect with Sales Team |

ORB Billing | Salesforce, NetSuite and QuickBooks | 30 days |

1. Revenue 365

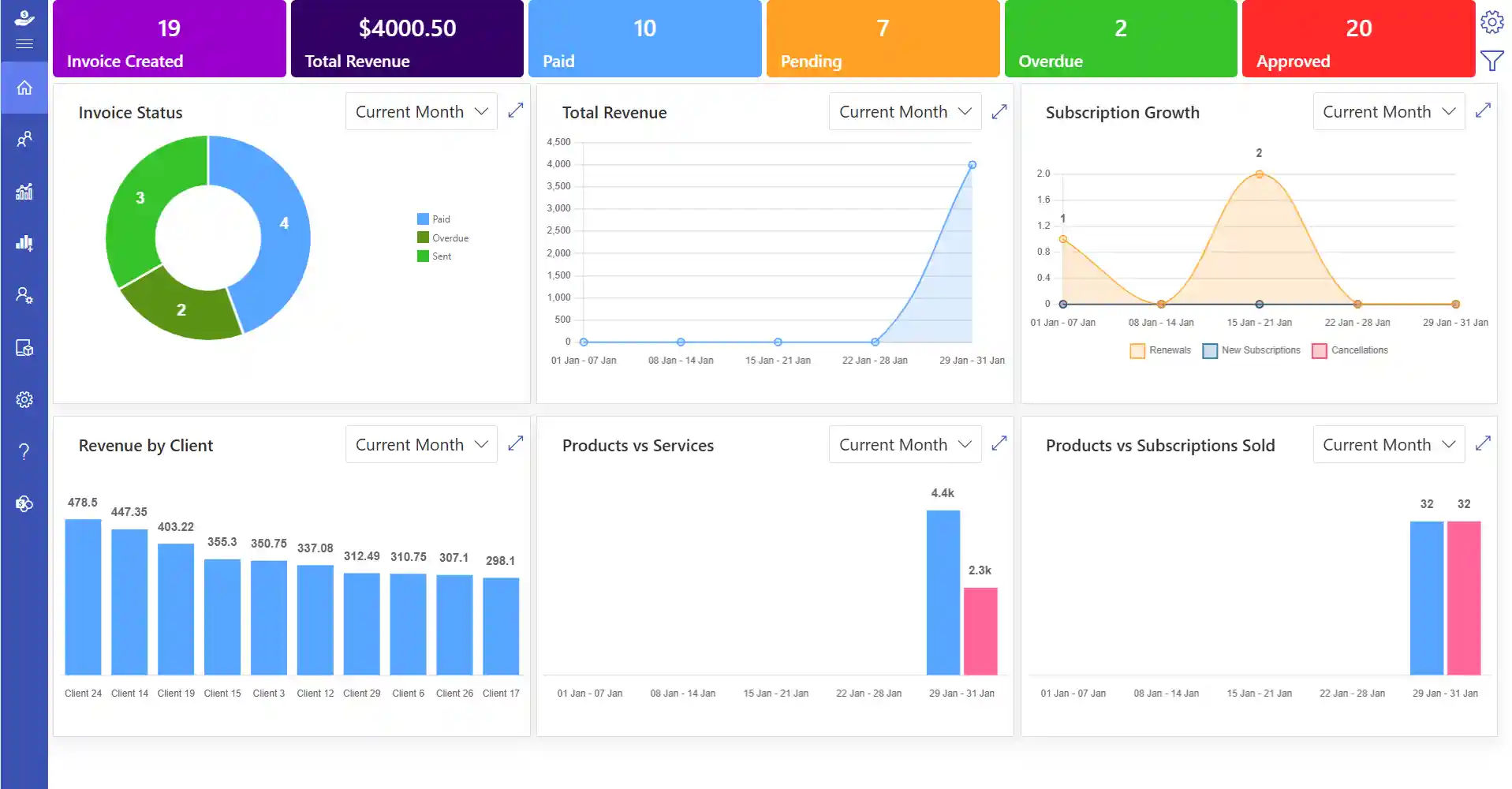

Revenue 365 is a strong alternative to Recurly, created to serve companies that require a reliable subscription billing and revenue management solution. It is developed in Microsoft ecosystem and is highly security and compliance oriented. It integrates with Microsoft 365 and therefore can be used well in organizations that already have Microsoft tools. One system allows businesses to handle subscriptions, billing, revenue tracking, and reports.

Key Features

- Automated invoicing and subscription billing

- Power BI-supported reporting and analytics

- Helps control SaaS subscription

- Supports fixed, tiered and usage-based pricing

- Manages various currencies and tax regulations

- Role based access with Microsoft Azure

- Constructed to facilitate business growth

- Supports pro-forma invoices

- Personalized invoice designs

Benefits

- Automates billing operations

- Prepares transparent financial statements in accordance with international standards

- Provides business insights in real-time to use in planning

- Operates effectively with Microsoft products that are used daily

- Secures information with Microsoft certified systems

What Makes Revenue 365 a Recurly Alternative

Revenue 365 is one of the Microsoft-certified platforms that unites subscription billing and revenue management in a safe and trusted Microsoft setting.

2. Zuora

Zuora is a well-established in the field of subscription billing and is popular among big firms globally. Zuora is often considered one of the pioneers of the subscription economy and it assists in billing, collections, quoting, and revenue tracking. It is applicable to organizations dealing with complicated prices and high number of subscribers.

Key Features

- Manages subscription lifecycle management

- Computerized billing and collection of payment

- Tailor-made product and price arrangement

- Subscription analytics and metrics

- Multi-currency and tax management

- Automation of billing workflow

- Integration with enterprise tools

Benefits

- Handles heavy billing requirements

- Favors complicated pricing systems

- Gives a clear picture of the revenue trends

- Meet accounting and reporting requirements

- Favors global operations

What Makes Zuora a Recurly Alternative

Zuora is known for handling large-scale subscription models and serving enterprises with complex billing needs.

3. Chargebee

Chargebee is a rapidly expanding subscription billing solution that is used by both startups and established companies. It favors SaaS, eCommerce, and companies that are subscription oriented. It has flexible prices and numerous integrations, which assist businesses in managing recurring payments as they expand.

Key Features

- Repeat billing and invoicing

- Unsuccessful recovery of payments tools

- Various prices and discounts

- Revenue tracking and reports

- Global currency and payment gateway support

- Self-service portal to customers

- Dashboard of subscription analytics

Benefits

- Reduces manual billing operations

- Helps retrieve overdue payments

- Suitable to different business models

- Enables the opening of international markets

- Enhances customer experience by self-service

What Makes Chargebee a Recurly Alternatives

Chargebee is widely chosen for its flexible billing setup and suitability for SaaS-based businesses.

4. Paddle

Paddle is a single platform designed to manage software companies to deal with revenue and payments. It includes the entire subscription process, helps track annual recurring revenue, billing, payment collection, taxation, and compliance processes. Companies that sell internationally find paddle very popular as it automatically handles international tax regulations.

Key Features

- Subscription billing and payment handling

- Built-in VAT, GST, and sales tax support

- Fraud monitoring and chargeback handling

- Customer account management

- Optimized checkout for SaaS products

- Revenue and churn insights

- Multiple currencies and payment methods

Benefits

- Reduces the burden of tax management

- Facilitates international transactions on a single platform

- Secures revenue through fraud protection

- Improves checkout experience

- Supports business growth in new regions

What Makes Paddle a Recurly Alternatives

Paddle is best known for combining global tax handling with subscription billing in one system.

5. Maxio

Maxio is a B2B SaaS company that requires intensive financial visibility, created through the merger of SaaSOptics and Chargify. It integrates billing automation with revenue tracking and financial reports, which is appropriate to mid-size and enterprise SaaS teams. It helps businesses generate bills electronically.

Key Features

- Automated SaaS billing

- Revenue recognition tools

- Tracking of subscription and contract

- SaaS metrics and cohort analysis

- Predict and forecast financial statements

- Payment recovery tools

- Multi-currency support

- Integration with CRM system

Benefits

- Gives good financial information

- Reduces manual billing work

- Provides SaaS-specific performance measures

- Deals with long-term contracts and revenue plans

- Supports growing SaaS businesses

What Makes Maxio a Recurly Alternatives

Maxio is known for its strong focus on financial reporting and revenue tracking for SaaS companies.

6. Zoho Subscriptions

Zoho Subscriptions belongs to Zoho business suite and targets small and mid-sized businesses. It provides an easy method of handling recurring billing and collaborates with other Zoho applications. The software helps businesses to generate billing, customize billing, automated invoices, and customer self-service services to assist businesses.

Key Features

- Invoicing and payment reminders

- Flexible plans and add-ons

- Tax and currency support

- Self-service portal of customers

- Subscription reports

- Automated billing cycles

- Mobile app access

Benefits

- Budget-friendly pricing for SMBs

- Quick setup and simple interface

- Helps maintain steady cash flow

- Supports international customers

- Works well with other Zoho tools

What Makes Zoho Subscriptions a Recurly Alternatives

Zoho Subscriptions is known for its affordable pricing and tight connection with the Zoho ecosystem.

7. DealHub.io

DealHub.io is an integration of subscription billing and CPQ with B2B sales teams. It is aimed at enhancing sales processes and running subscriptions, contracts, and revenue under the same platform. Approval flows and reporting are also supported on the platform to keep the sales and finance teams in line.

Key Features

- CPQ for quotes and proposals

- Renewals and subscription billing

- Contract life cycle management

- Digital sales rooms

- Revenue reporting

- Approval workflows

- Currency and compliance support

Benefits

- Speeds up sales quoting

- Keeps contracts and billing aligned

- Reduces manual sales steps

- Improves buyer engagement

- Connects sales and finance data

What Makes DealHub.io a Recurly Alternatives

DealHub.io is known for blending CPQ and subscription billing into one sales-focused platform.

8. ORB Billing

ORB Billing is a modern subscription billing solution designed to serve businesses that charge their customers per usage. The software helps create invoices, as per various pricing models and suits well to those businesses that are growing at a rapid rate. It also has real-time usage tracking and billing insights.

Key Features

- Usage-based and tiered pricing

- Automated billing cycles

- Real-time usage tracking

- Payment recovery tools

- Multi-currency and tax handling

- Billing analytics

- Customer self-service options

- Built for growth

Benefits

- Favors detailed usage pricing

- Improves payment recovery

- Provides transparent customer usage

- Facilitates international billing requirements

- Adapts well to growing businesses

What Makes ORB Billing a Recurly Alternatives

ORB Billing is best known for handling usage-based billing models and supporting fast-growing companies.

Key Steps to Review Before Implementation

Moving to a subscription billing platform is an important step for business growth and revenue tracking. The outcome depends largely on how well you prepare before setup. Below are the key areas to review before moving forward.

1. Clarify Your Billing Needs

Begin by enumerating what your business requires at the present and what it might require in the future. Proper planning will prevent additional complexity and aid in the improved choice of platform.

- Choose between recurring or usage-based billing model or both

- Select a platform that aligns with your existing workflows

- List features include discounts, add-ons, free trials

2. Review Compliance and Data Safety

Billing systems deal with confidential customer and revenue information. One should select software that complies with tax regulations and ensures the safety of data. Early checks minimize future risks and legal matters.

- VAT, GST and regional tax support Checks

- Conduct review certifications, e.g. SOC 2 or ISO

- Ensure that the platform has high data protection measures

3. Check System Compatibility

Your billing software must be compatible with the tools that you already have. Good connectivity saves on manual work and assists teams to get access to consistent data.

- Connect with analytics, office tools and accounting

- Allow billing information to enter reporting systems to be more

- Set up workflows to prevent isolated information between groups

4. Prepare for Business Expansion

Think beyond current needs. The billing needs with your business tend to vary with new markets, price plans, and volumes of customers as your business expands.

- Advanced pricing and contract review.

- Choose a platform that is long term and does not require frequent system changes.

- Check multi-currency and international tax support

5. Bring Teams into the Process Early

Several departments are affected by billing software. Involvement at an early stage assists in gathering actual requirements and prevents future delays.

- Add finance, IT, operations and support teams

- Gather feedback about reporting, workflows, and integrations

- Match the platform selection to the general business objectives

6. Test Before Full Launch

A trial phase helps identify gaps and prepares teams before the system is rolled out company-wide.

- Run a pilot with a small group

- Fix workflow issues found during testing

- Train teams fully before launch

Conclusion

The selection of the appropriate Recurly alternative is one of the factors that determine the level of success of your business in managing subscriptions, billing, and tracking of revenues.

Revenue 365 is a powerful solution to organizations that are on Microsoft tools or those that require a secure, scalable and compliant billing platform.

Learn about Revenue 365 and how it would help you with your billing requirements as your business expands.

Join Our Creative Community

Frequently Asked Questions

What are the best alternatives to Recurly for SaaS businesses?

Yes, access can be restricted by role to ensure security and proper document handling.

Are there Recurly alternatives that work well with Microsoft 365?

Yes. alternatives like Revenue 365, Zuora, and Chargebee integrate well with Microsoft 365, Power BI, and Azure.

What should I look for when choosing a Recurly alternative?

Look for flexible pricing models, strong tax support, clear reporting, system integrations, and the ability to scale as your business grows.

What are the best Recurly alternatives for SMBs?

For SMBs, popular Recurly alternatives include Revenue 365, Zoho Subscriptions, and Paddle, offering simplicity and cost efficiency.

How do I decide between Recurly and its alternatives?

The decision depends on your current and future billing needs. Compare flexibility, integrations, reporting, and scalability to find the best fit.

_JiluXJRGNl.svg)